.

I do not have the moral authority to indenture my neighbors over good intentions. And neither do you.

#ThinkLIbertarian

#taxationistheft

Interesting. Antarctica Sea Ice Has “Slowly Increased” Since 1979, Science Paper Finds

Libertarians oppose through persuasion and market choices, not laws. We believe in individual freedom, advocating for change via education and voluntary action, not government coercion.

#ThinkLibertarian

Public education fails because the government has no incentive to provide a quality product.

Funding for schools is guaranteed through taxes, which people must pay whether or not they are satisfied with the education system. These taxes are enforced by laws, and refusing to pay can lead to fines or imprisonment. This system forces people to support public schools even if they believe those schools are failing.

Accountability in public education is nearly impossible. Schools do not rely on satisfying parents or students to stay funded. Instead, they are run by government bureaucracies that make decisions far removed from the needs of individual families. Parents cannot withhold their tax dollars to protest poor performance, and most families cannot afford private school tuition after paying taxes to fund public schools. This leaves them trapped in a system that does not have to compete for their support.

Public schools operate as a monopoly. There are no consequences for poor performance because families have few alternatives. Unlike businesses in a free market, schools do not have to compete to attract customers. If a business offers bad service or products, people can stop buying them. Public education does not allow this option, so schools have no reason to improve.

The system rewards inefficiency. Bureaucracies grow, teachers’ unions protect underperforming staff, and students suffer the consequences. Innovation and improvement are rare because there is no pressure to do better. The guaranteed funding and lack of competition create a stagnant system that prioritizes its own survival over quality education.

This structure fails students and families. Without competition, schools do not have to prove their value. The result is a system that costs taxpayers billions while delivering mediocre results. Families cannot escape it, and the government has no reason to fix it.

Stapler brings it together.

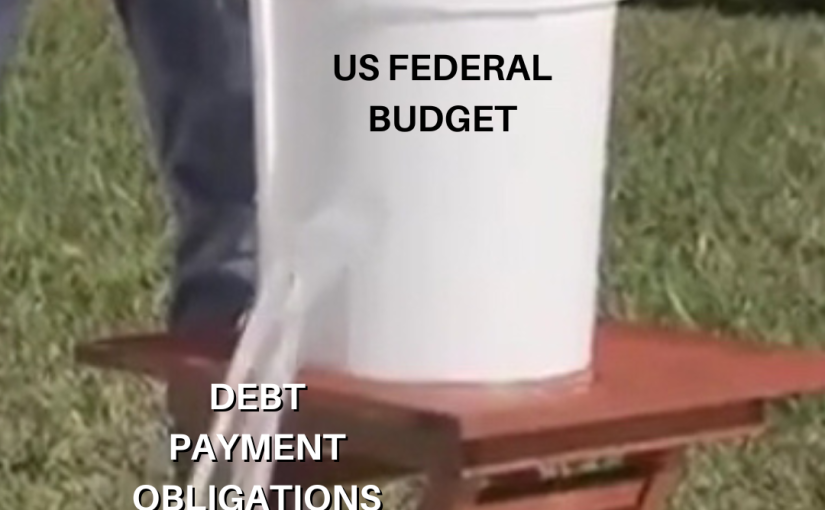

It’s actually much worse.

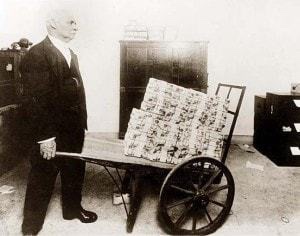

We won’t have to wheel around stacks of money to buy bread, but the pain will be the same.

Amendment Proposal: The Freedom of Relationship and Contract Amendment

Section 1: Purpose

The State of Ohio recognizes the inherent right of individuals to form personal relationships and enter into contractual agreements without government interference. This amendment ensures that the regulation of marriage and other relationship contracts remains outside the purview of the state government, preserving personal autonomy and equality under the law.

Section 2: Rights of Individuals

(A) The State of Ohio shall not define, regulate, license, or restrict the formation of personal relationships or contractual agreements between consenting individuals.

(B) No legal distinction shall be made based on the nature, form, or participants of personal relationships or contracts, provided all parties are of legal age and consent.

Section 3: Legal Contracts and Protections

(A) Individuals entering into relationship agreements may establish private contracts to define their rights, responsibilities, and obligations.

(B) Courts shall adjudicate disputes concerning such agreements under existing principles of contract law, without preference or prejudice based on the nature of the relationship.

Section 4: Non-Discrimination

(A) Public and private entities within the State of Ohio shall recognize and treat all private relationship agreements equally under the law.

(B) No individual or group shall be compelled to participate in, recognize, or facilitate any relationship agreement contrary to their beliefs, provided such refusal does not violate other established laws prohibiting discrimination.

Section 5: Transition Provisions

(A) Existing marriage licenses and state-recognized relationship agreements shall remain valid but will no longer require state renewal or oversight.

(B) All references to “marriage” or similar terms in Ohio law shall be interpreted as private agreements between consenting individuals, without requiring government recognition.

Section 6: Severability

If any provision of this amendment is found to be unconstitutional or invalid, the remaining provisions shall remain in full force and effect.

This amendment aims to shift the regulation of personal relationships from the state to the individuals involved, using contract law to protect their agreements while ensuring that discrimination and undue burdens are avoided.

This is a draft proposal for discussion purposes only and not endorsed by FCLPO.